Understanding Correlation in Modern Portfolio Theory

In Modern Portfolio Theory (MPT), understanding the correlation between stocks in a portfolio is crucial for finding the "efficient frontier" or curve. Here’s a simple explanation focused on the correlation part:

Correlation in finance measures how stocks move in relation to each other. When you have multiple stocks in a portfolio, they don't all move up or down at the same time or by the same amount. The correlation calculation tells us the relationship between these movements.

- Highly Correlated Stocks: These stocks tend to move in the same direction. If one stock goes up, the other is likely to go up as well, and vice versa.

- Low or Negatively Correlated Stocks: These stocks move quite independently of each other. When one goes up, the other might go down, stay the same, or not go up as much.

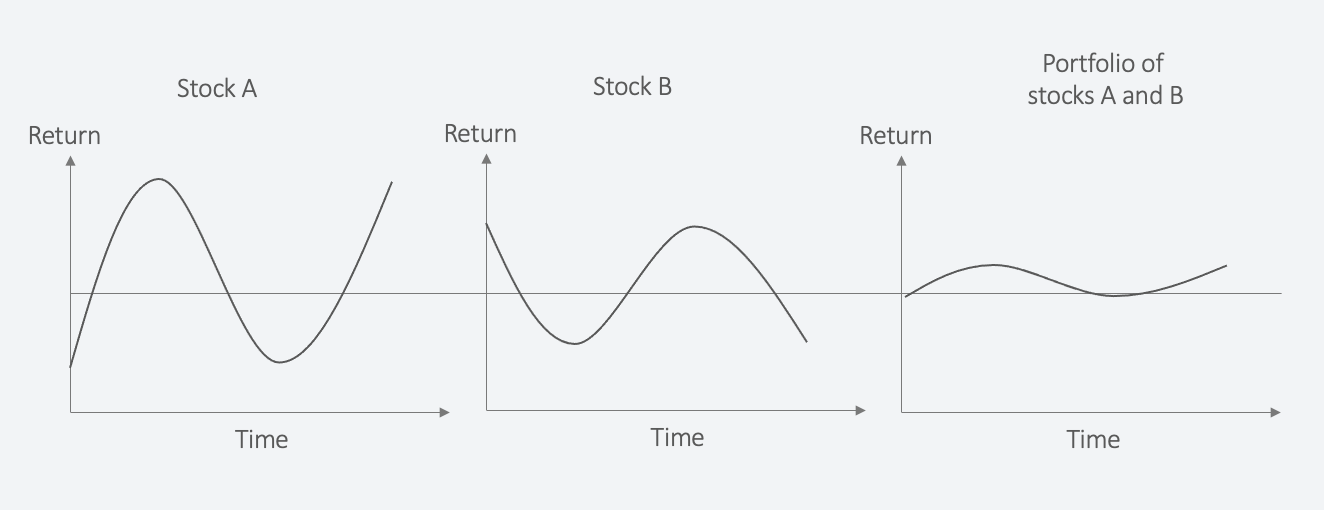

| Stock A and stock B are highly volatile assets and negatively correlated. They balance each other and create a portfolio with reduced volatility. |

|

In MPT, the goal is to mix stocks in a way that reduces overall risk without sacrificing potential returns. To do this, the app calculates the correlation between all pairs of stocks in your portfolio. By understanding these relationships, the app can then determine the best combination of stocks that work together to reduce risk (volatility) while aiming for the desired returns.

So, the correlation calculation is a key step in MPT to build a diversified portfolio where the risks of individual stocks can offset each other. This diversification is what helps in aiming for the most efficient balance of risk and return, which is represented by the efficient frontier curve.

Correlation Boost

Low Correlation Boost - In case you need another reason - most investors understand that adding low correlation returns to a portfolio will reduce portfolio risk. However, very few appreciate how much low correlation assets can improve the overall portfolio return. The return enhancement comes from the annual rebalancing from the outperforming investment to the underperforming one. Since the two uncorrelated assets produce comparable long-term returns through very different paths, the repeated buy-low and sell-high discipline accrues over time. We call this hidden benefit the “low correlation boost.” The lower the correlation the greater the boost potential because of the increased dispersion of returns between the two investments. This is a well-known and widely documented phenomenon(1) that is commonly overlooked.

1 One example of a long-standing research article on the subject is Bernstein, William J. “The Rebalancing Bonus: Theory and Practice.” Efficient Frontier: An Online Journal of Practical Asset Allocation. September 1996. http://www.efficientfrontier.com/ef/996/rebal.htm.

Register