The Modern Portfolio Theory (MPT)

MPT is a financial theory that describes, in mathematical terms, concepts such as diversification and risk management. MPT offers the investor a toolset for building a diversified portfolio, whose return is maximized for a given level of risk. The risk is commonly measured with the standard deviation or volatility.

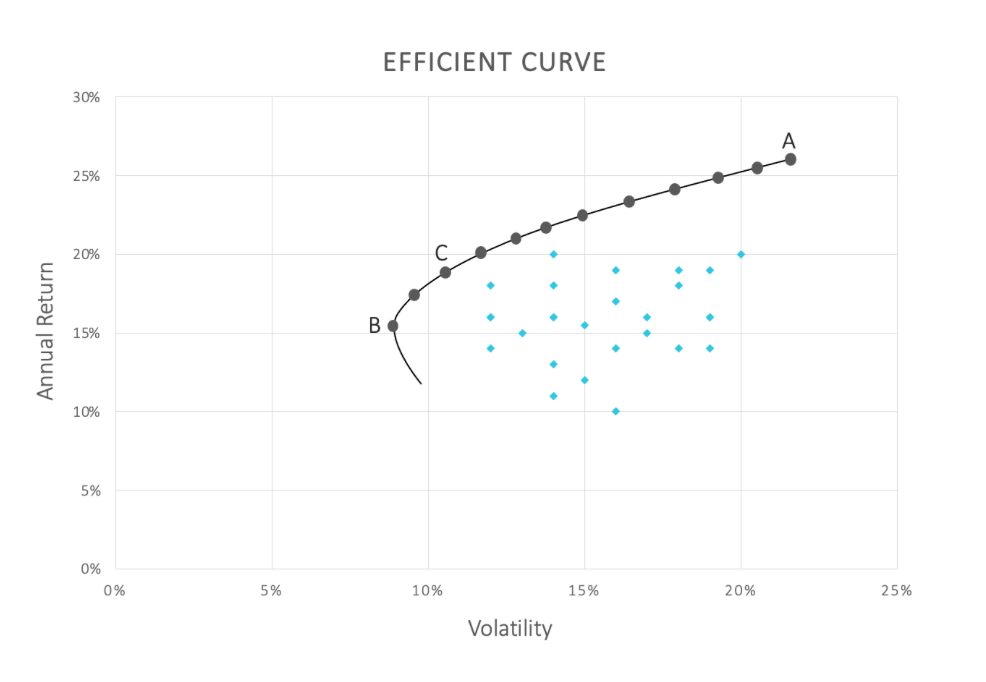

An output of the MPT is the efficient frontier curve shown on the right. It looks like an upside down Nike swoosh. All the dots (in cyan) below and to the right of the curve represent the risk and return of portfolios that are less than efficient for various reasons. The dots that are on the curve represent portfolio performances that are considered efficient. There are three noteworthy points on the curve:

- Point A is the most aggressive portfolio with the highest return

- Point B is the most conservative portfolio with the lowest risk

- Point C is typically the investor’s preferred choice, also known as the optimal portfolio, as it is thought to be a good compromise between the level of risk and the expected return. This is also the point in which the portfolio has the maximum Sharpe ratio.

Bilanx provides a clear path to smarter investing by offering tailored allocation strategies for three efficient portfolios. These are designed based on your existing stocks but with adjusted allocations to optimize the balance between risk and potential returns. Think of it this way: if your current investments fall below the efficient frontier curve, you may be shouldering unnecessary risk. With Bilanx, you have the control to set the level of risk you're comfortable with while aiming to maximize your returns for that chosen risk level.

Moreover, as your financial goals evolve, Bilanx proves to be an invaluable resource. Whether you're looking to rebalance your portfolio over time or considering adding or removing specific stocks, Bilanx provides insightful analysis to help you understand the impact of these changes. This way, you can make informed decisions to keep your investments aligned with your financial goals.